Personal Loans Canada - Questions

Personal Loans Canada - Questions

Blog Article

Personal Loans Canada Fundamentals Explained

Table of ContentsUnknown Facts About Personal Loans CanadaSome Known Facts About Personal Loans Canada.Some Ideas on Personal Loans Canada You Should Know9 Simple Techniques For Personal Loans Canada5 Easy Facts About Personal Loans Canada Described

This means you have actually provided every solitary buck a work to do. placing you back in the chauffeur's seat of your financeswhere you belong. Doing a regular budget plan will certainly give you the self-confidence you require to handle your money effectively. Great things involve those that wait.Conserving up for the big things implies you're not going into financial obligation for them. And you aren't paying much more in the lengthy run as a result of all that passion. Trust fund us, you'll enjoy that family cruise ship or play area set for the kids way more understanding it's already paid for (rather of making payments on them till they're off to college).

Nothing beats peace of mind (without financial obligation of training course)! You don't have to transform to personal loans and debt when points obtain tight. You can be complimentary of debt and start making actual traction with your money.

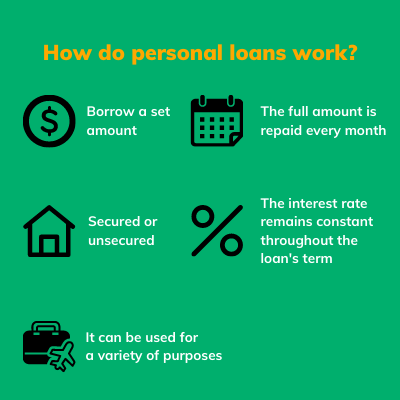

They can be safeguarded (where you provide collateral) or unsafe. At Spring Financial, you can be approved to obtain money as much as car loan amounts of $35,000. A personal lending is not a credit line, as in, it is not rotating funding (Personal Loans Canada). When you're authorized for an individual lending, your loan provider provides you the sum total simultaneously and then, typically, within a month, you start repayment.

Excitement About Personal Loans Canada

Some financial institutions placed stipulations on what you can make use of the funds for, but many do not (they'll still ask on the application).

The need for individual fundings is climbing amongst Canadians interested in leaving the cycle of cash advance finances, consolidating their debt, and restoring their credit rating rating. If you're using for a personal lending, here are some points you need to maintain in mind.

The 5-Second Trick For Personal Loans Canada

In addition, you may be able to lower how much total passion you pay, which indicates even more cash can be saved. Individual loans are powerful devices for constructing up your credit rating. Settlement history make up 35% of your credit report, so the longer you make see this page normal repayments on time the extra you will certainly see your score rise.

Individual car loans provide a great possibility for you to rebuild your credit report and settle financial debt, yet if you do not spending plan correctly, you could dig on your own into an also much deeper opening. Missing one of your month-to-month repayments can have a negative result on your credit rating but missing a number of can be more information ravaging.

Be prepared to make each and every single settlement on time. It holds true that an individual lending can be utilized for anything and it's simpler to get authorized than it ever before remained in the past. Yet if you don't have an immediate need the additional money, it might not be the very best solution for you.

The fixed monthly settlement amount on an individual lending depends on exactly how much you're obtaining, the rate of interest, and the set term. Personal Loans Canada. Your rates of interest will rely on aspects like your credit rating and revenue. Most of the times, personal financing prices are a lot reduced than bank card, however in some cases they can be greater

5 Easy Facts About Personal Loans Canada Described

The marketplace is wonderful for online-only lenders lending institutions in Canada. Benefits consist of wonderful rates of interest, incredibly fast Read Full Article processing and funding times & the privacy you might desire. Not every person suches as walking into a financial institution to request for cash, so if this is a difficult place for you, or you just do not have time, looking at online loan providers like Spring is a great choice.

That largely depends on your ability to repay the amount & advantages and disadvantages exist for both. Repayment lengths for personal loans normally drop within 9, 12, 24, 36, 48, or 60 months. Occasionally longer settlement periods are a choice, though unusual. Much shorter settlement times have very high regular monthly settlements but then it's over promptly and you don't shed more money to passion.

Personal Loans Canada Fundamentals Explained

You might obtain a reduced interest rate if you finance the financing over a shorter duration. A personal term lending comes with a concurred upon settlement schedule and a fixed or floating interest rate.

Report this page